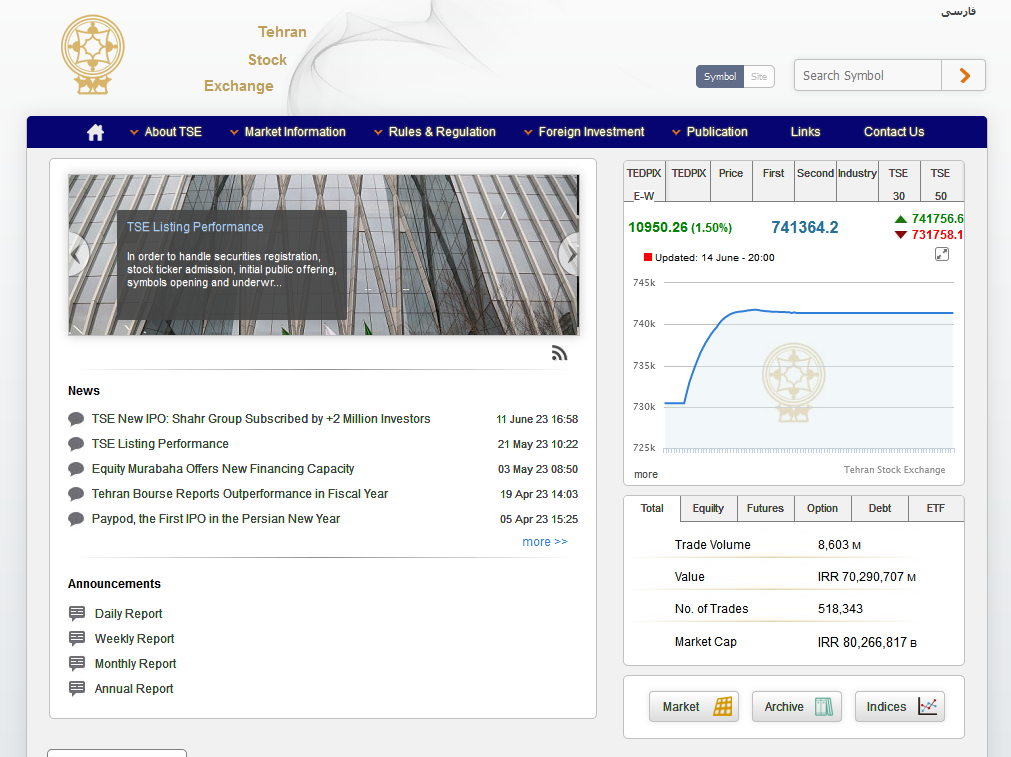

Investing in the Tehran Stock Exchange

The Tehran Stock Exchange (TSE) is a vibrant financial marketplace in Iran, offering a platform for companies to raise capital and for investors to grow their wealth. This article will guide you through the workings of the TSE, the process of buying and selling shares, and strategies for successful investing.

How the Tehran Stock Exchange Works

The TSE operates similarly to other stock exchanges around the world. Here's a simplified overview:

1. Listing: Companies list their shares on the TSE to raise capital. They provide detailed financial information to attract investors.

2. Trading: Investors buy and sell shares through brokers during trading hours. The prices of shares fluctuate based on supply and demand.

3. Settlement: After a trade is executed, the settlement process ensures the transfer of shares and money between the buyer and seller.

How to Buy and Sell Shares

Investing in the TSE involves the following steps:

1. Open a Trading Account: You'll need to open a trading account with a licensed broker. This account allows you to buy and sell shares.

2. Research: Before buying shares, conduct thorough research on the company. Review its financial statements, industry position, and market trends.

3. Place an Order: Once you've decided which shares to buy, place an order with your broker. You can specify the number of shares and the price at which you're willing to buy.

4. Monitor and Sell: After purchasing shares, monitor their performance. When you're ready to sell, place a sell order with your broker.

Successful Investing Strategies

Investing in the TSE can be profitable if you follow these strategies:

- Diversification: Don't put all your eggs in one basket. Spread your investments across different companies and sectors to reduce risk.

- Long-Term Investing: Stock markets can be volatile in the short term. Consider investing for the long term to ride out market fluctuations.

- Regular Investing: Instead of trying to time the market, invest a fixed amount regularly. This strategy, known as dollar-cost averaging, can reduce the impact of price volatility.

In conclusion, investing in the Tehran Stock Exchange can be a rewarding venture if you understand how it works, know how to buy and sell shares, and follow successful investing strategies.